Analysts: T-Mobile and Sprint doomed if they merge, doomed if they don’t

For the best part of the last 6 months we’ve heard and read many different takes on the possible merger between T-Mobile and Sprint. Up until recently – when the merger was purely speculation and messages along the grapevine – analysts had mostly been singing from the same hymn sheet. The chorus: Sprint and T-Mobile need to merge, or one of them (at least) is doomed.

The argument was seemingly that the two companies are both in need of network expansion, since neither had a truly nationwide LTE network. Both are also losing money. While T-Mobile revenue finally swung back in to growth last quarter, it still reported an operating loss despite adding over 2.5 million net subscribers. Sprint lost subscribers, saw its revenue drop, and reported a loss. So neither is in the healthiest position. This of course means they need each other to survive, or at least, it did.

More recent comments by analysts and industry watchers would seemingly argue against a merger, for almost the exact same reasons. And many others to boot. One team – at Merrill Lynch – is not at all enthused by the prospect of a merger deal. As noted by 247WallSt.com:

The team is also not impressed with the merger’s chance for approval, which has already been an issue for regulators. Lastly, Merrill Lynch doesn’t even like the combined company’s chances of success in the long-run, even if the deal is allowed and consummated.

The report goes on to detail the plusses and negatives of any potential merger. On the plus side, we have the information that the FCC recently pushed through changes to the rules for next year’s major spectrum auction. It would see Sprint and T-Mobile being in prime position to acquire much-needed low-band spectrum. That said, with the FCC benefiting Sprint and T-Mobile so blatantly, it also indicates the intention to keep a four-carrier market. Part of the conditions of the new FCC rules stipulated that the rules will be null and void if a major transaction between smaller carriers goes through. If a deal did go through, it would have to be completed after the auction, or the merged company would lose the right to bid on the portion of spectrum kept aside for the two individual carriers. On the “almost positive” side is that at least one FCC commissioner is open minded on a merger.

Cautionary messages are sent when it comes to Wall Street’s valuation of company stock, however. If Sprint or T-Mobile share price climbs purely on the basis of merger rumors, that’s not a particularly healthy sign. Merrill Lynch believes that if Sprint and T-Mobile spend the next year (maybe more) trying to convince regulators that they’re doomed on their own, it doesn’t exactly encourage faith from investors. And, that the two companies’ valuation is mostly based on potential of a super-powerwful merged company. Not on the financial reality of their current state.

Merril Lynch isn’t the only analyst team against the idea. Craig Moffett of MoffettNathanson can’t see an easy way to merge and be successful, unless Sprint slashes its plan prices. Referring to Masayoshi Son, he stated “I think he’s realized he’s between a rock and a hard place. Sprint’s prices are much too high, but if Sprint cuts prices, its stock will fall. They don’t come close to justifying their stock price.”

The problem is that if Sprint does cut its prices to try and match T-Mobile, that would hurt its stock prices. And its valuation, despite awful financial performance, has grown 8% based on rumors that it’ll join forces with the more attractive and disruptive T-Mobile.

Sprint customers – on average – spend $62 per month, while T-Mobile subscribers are around $50 per month according to a report from Reuters. As plans progress for the two companies to merge, it’s clear that an average spend gap like this isn’t a sustainable financial model. Michael McCormack of Jefferies states “It is not a sustainable situation. If the companies merge, they will need uniform pricing across the company.”

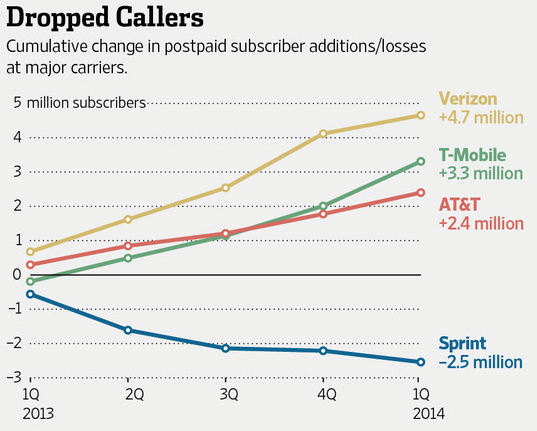

And those aren’t the only concerns. T-Mobile and Sprint individually both lost money last quarter. Neither is really making any profit – as mentioned previously. And while T-Mo is gaining a lot of subscribers, Sprint is losing a lot. Looking at just postpaid subscribers, Sprint lost 2.5 million over the 5 quarters between Q1 2013 and the end of Q1 2014. The Uncarrier gained 3.3 million. Evened out, that’s a gain of just 800,000 postpaid subscribers between them over 15 months.

And as we showed you yesterday, even in terms of coverage the two carriers don’t benefit each other that much. Both cover pretty much the same metro areas, and Sprint coverage reaches very few areas T-Mobile doesn’t.

In short: It is tough to see how a merger would benefit T-Mobile, except by more than doubling the subscriber base and increasing its spectrum holdings. It has far more potential to benefit Sprint at this moment in time. Does it benefit the US consumer, or market as a whole to have another major carrier around? That is also unclear.

A big problem in judging Sprint’s individual potential is that the past year hasn’t been great, mostly for one reason: It’s going through a massive overhaul of its network. Ditching tons of its old technology in favor of the new “Spark” LTE network. Any company going through such a major change is bound to feel the pinch during the bumpy transition. Once the network is living and active, that is when a better assessment can be made. Besides, T-Mobile LTE roll-out is still going strong. It’s activating VoLTE in numerous cities, upgrading others from 2G/EDGE to HSPA+ and LTE, and others are getting super-fast 15+15 and 20+20 networks.

Point being: All this upgrading costs money. And once completed, T-Mobile’s overheads should drop, meaning the growth in revenue will eventually turn in to a growth in profits too.

Via: Reuters, 247WallSt, PhoneArena