T-Mobile Money full benefits now available to Sprint customers

Earlier this year Sprint customers got access to T-Mobile Tuesdays thanks to the merger of the two carriers, and now Sprint users are getting another T-Mo feature.

T-Mobile Money benefits are now available to Sprint customers who sign up for the banking service. That includes a 4.00% Annual Percentage Yield (APY) on balances up to $3,000 and 1.00% APY after so long as you’re depositing at least $200 every month. Everyone else gets 1.00% APY on all balances.

Another benefit coming to Sprint customers is Got Your Back overdraft protection. This means that users can go up to $50 in the red without penalty, they just need to bring the account to a positive balance within 30 days to use the service again.

Also recently added to T-Mobile Money is the ability to make cash deposits at participating merchants like Walmart, CVS, 7-Eleven, and Walgreens. And when users set up direct deposit into their T-Mobile Money account, their paycheck can be available up to two days before a traditional bank would allow access to the money.

Finally, T-Mobile Money users get no monthly, overdraft, account, or transfer fees, plus they get access to more than 55,000 in-network Allpoint ATMs with no fees.

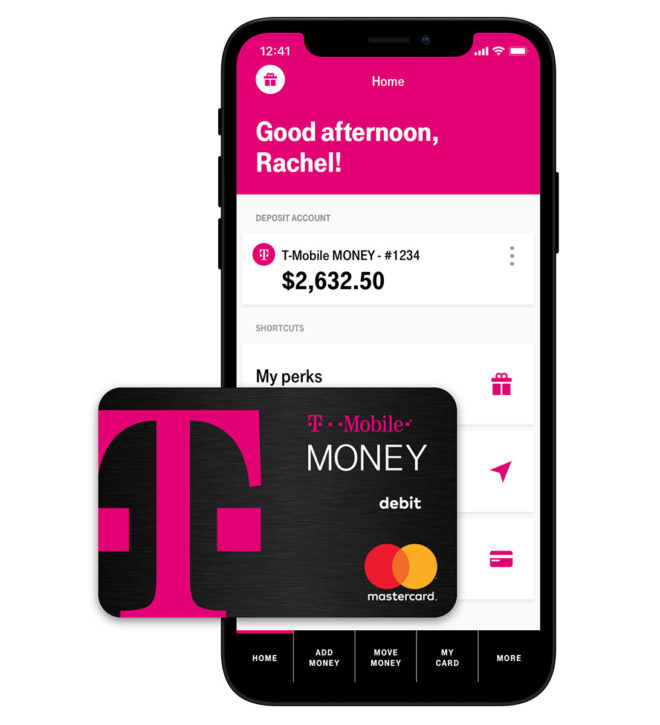

T-Mobile Money officially launched in April 2019 as T-Mo’s new mobile-focused banking effort. It’s got a mobile focus, letting you open and manage your account from your phone, and you can also use your device to get 24/7 support and find an Allpoint ATM if you need to get cash out. Users also get a Mastercard debit card for those times when a physical payment method is needed.

T-Mobile Money apps are available on both Android and iOS.

Source: T-Mobile