Largest MetroPCS Investor Reverses Tune, Comes Out In Support Of T-Mobile Merger

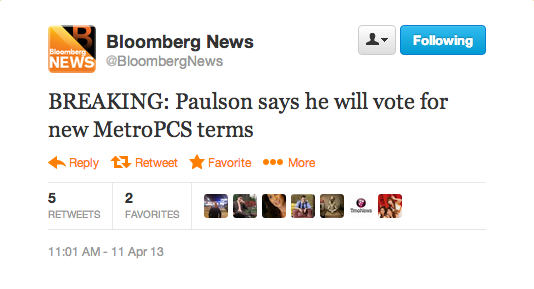

Paulson & Co., MetroPCS’ largest shareholder and the loudest voice of opposition against the T-Mobile deal has changed their tune after the revised terms issued by Deutsche Telekom late yesterday afternoon.

“While Paulson needs to review the revised proxy statement before making a final decision, Paulson intends to vote for the merger as restructured,” the firm, founded by billionaire John Paulson, said today in a statement.

Deutsche Telekom issued their “best and final offer” by cutting the amount of debt the combined company would acquire by $3.8 billion. DT also lowered the interest rate it plans to charge on the loan by half a percentage point. “This improved offer underlines Deutsche Telekom’s commitment to establishing a new, stronger competitor in the U.S. mobile communications market,” the company said.

Jonathan Chaplin, analyst with New Street Research LLP in New York said the company would be in a better position under the new deal to make network investments and acquire more spectrum. “This puts the new company under less pressure and gives them more strategic flexibility,” said Chaplin.

As for questions surrounding Deutsche Telekom’s long-term commitment to the new company, spokesman Philipp Kornstaedt said the German telecommunications giant has an “enduring commitment” to the US market.

The second loudest opposition voice, P. Schoenfeld Asset Management said in a brief statement that it welcomed the move by DT and would review the new terms.

“PSAM is pleased that Deutsche Telekom — in response to strong opposition to the deal from shareholders — has taken steps to improve the terms,” the firm said.

Analysts agree that the new terms of the deal should be enough to push shareholders into agreement that this is now a better deal for them rather than remaining independent.