Industry Analyst Speculates The Tide Has Finally Turned In T-Mobile’s Favor

With T-Mobile’s first truly positive quarterly results still fresh in the mind of industry analysts, at least one such industry watcher is publicly stating T-Mobile is on the prowl. In a research note last Friday, UBS Investment Research analyst John Hodulik notes that T-Mobile’s second quarter successes means “more upside” for T-Mobile’s share value. Hodulik also insinuated that the successes of T-Mobile are likely to be a “bad omen” for investors looking to earn higher margins from the likes of AT&T and Verizon.

T-Mobile has emerged as an aggressive share-taker far sooner than expected and porting ratios in July suggest the worst may not be over. The Un-carrier 3.0 launch, expected by Halloween, will be another shot across the bow, forcing the larger carriers to sacrifice margins and/or share. Layering on a resurgent Sprint in 2014 makes higher wireless margin estimates start to look like a stretch.

Hodulik further notes that T-Mobile gained share from the other big three carriers and saw its churn rate drop while the rest of the industry remained flat. Hodulik notes that according UBS calculations, T-Mobile was gaining two subscribers from AT&T and Sprint for every one it lost to those carriers. That sentiment has already been echoed by T-Mobile CEO John Legere in interviews following T-Mobile’s August 8th financial report.

That’s not to say we should write Sprint off just yet, as a “resurgent” Sprint is expected in the future now that the SoftBank deal is finalized. SoftBank has plenty of cash to pump into Sprint and it’s unlikely they’ll bide their time leaving Sprint as a still formidable competitor.

There are some market conditions Hodulik notes that will also work in the favor of T-Mobile and Sprint in their battle against AT&T and Verizon:

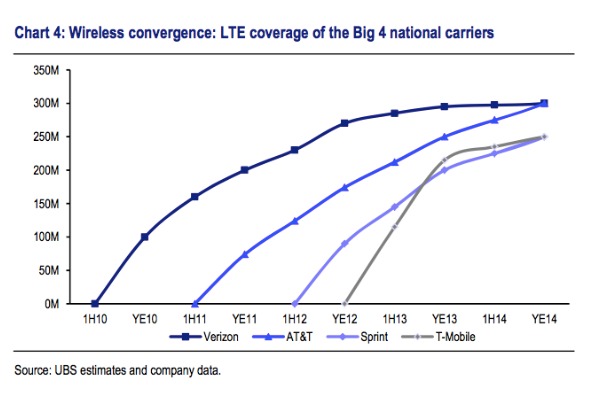

- For one, Sprint and T-Mobile’s LTE rollouts are coming on strong and while AT&T and Verizon still have a competitive lead, especially Verizon, T-Mobile went from 7 markets to 116 overnight.

- Second, postpaid growth is slowing, if not stalling altogether. USB forecasts that prepaid growth will accelerate once again as customers move away from contract plans in search of cheaper prices. Sprint and T-Mobile are ready for the prepaid march with the likes of Virgin Mobile and MetroPCS.

- The third and last reason is the war of attrition being fought in the US market. As the market itself becomes saturated, customer growth is gained by stealing customers from the “other guy.” Hodulik surmises that this will again benefit the likes of T-Mobile and Sprint as they both show a competitive streak in pricing and promotional offers. Whether or not AT&T and Verizon will cut prices and therefore cut their margins to match them is something that remains to be seen.

Hodulik isn’t just another fly-by-night analyst and he’s well respected in the industry. It’s possible his predictions could be premature, spot-on or just plain wrong. The analysis presented by Hodulik spans a three-month period, but the trends are there from a greater period.

I think T-Mobile’s CEO would agree that momentum is on their side and he sure isn’t letting up on the AT&T attacks. Still, It’ll take more than one-quarter of positive growth for us to say that T-Mobile is making headway against the monoliths that are Verizon and AT&T, but if they do, things are looking very, very up for T-Mobile indeed.