T-Mobile Hits Back At Verizon Over Spectrum Wars, Efficiency

We’re about to enter round 3 of the T-Mobile/Verizon tit-for-tat “blog post on spectrum” wars as T-Mobile responds to a late February Verizon post. T-Mobile hits back against Verizon’s claim that they use spectrum in a more efficient way by working to pick apart Verizon’s reasoning for such claims.

First, T-Mobile knocks Verizon’s analysis utilizing nationwide carriers total subscribers based on the average amount of spectrum. T-Mobile says spectrum holdings and marketshare vary dramatically based on market-by-market results and any analysis should be done at that level.

Second, Verizon’s claim includes spectrum being transferred to T-Mobile via AT&T as a result of the failed transaction which T-Mobile hasn’t taken control of it. This additional spectrum allows for T-Mobile’s spectrum efficiency to appear lower than it really is. T-Mobile also points out that Verizon fails to include the spectrum they are trying to acquire, the source of these blog posts in the first place.

Third, Verizon acknowledges that not all wireless users place equal demand on the network. T-Mobile says that Verizon declines to factor into its analysis that T-Mobile “has a higher percentage of bandwidth-hungry smartphone customers.”

Fourth and most important according to T-Mobile is Verizon’s failed accounting for the majority of its own spectrum in the bands below 1GHz, which is considerably more efficient than bands above 1GHz. All of T-Mobile’s spectrum is in the above 1GHz range.

T-Mobile then highlights analysis that takes these factors into account and reveals that T-Mobile is more efficient than Verizon in the top 5 markets, 8 of the top 10 markets, 31 of the top 49 markets and that on average, T-Mobile is 50 percent more efficient than Verizon in the top markets.

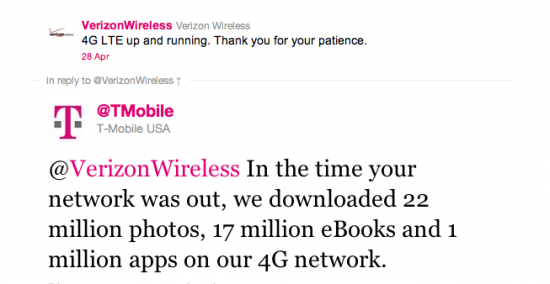

T-Mobile goes on to highlight the notion that Verizon is buying the “…last remaining block of spectrum that carriers like T-Mobile and others could utilize to launch competitive services in competition with Verizon.” T-Mobile continues with an assault on Verizon’s history of purchasing spectrum only to sit on it, where T-Mobile has a history of purchasing spectrum and immediately using it.

I’ve included the full press release below and if you’re interested in spectrum holdings among the major carrier, it’s a short read.

Full Press Release:

Verizon is on a buying spree these days – attempting to corner the spectrum market by purchasing one of the last remaining unused blocks of airwaves to create a stockpile. Verizon would have you believe its effort to purchase the cable companies’ Advanced Wireless Services (AWS) licenses in the 1.7 GHz band is but a “run of the mill” set of transactions that should be rubber-stamped by the FCC. Not true. These deals are anything but routine and, if granted, would unduly tip the scales in favor of the largest wireless carrier at a critical juncture in the mobile broadband industry.

To justify its continued buying binge, Verizon claims that it is one of the most efficient carriers in the world, and that it is two-times more efficient than T-Mobile. It doesn’t take long to find the flaws in Verizon’s claim. Here’s why:

First, Verizon’s analysis divides the carriers’ nationwide total subscribers by a nationwide average amount of spectrum. But mixing an absolute number of subscribers against a broad average of spectrum produces a pointless number. Because spectrum holdings and market share vary dramatically on a market-by-market basis, any meaningful analysis must be done at that level.

Second, Verizon includes spectrum in its calculation to which T-Mobile does not yet have access, making T-Mobile’s average appear lower. In particular, Verizon adds spectrum that T-Mobile will receive as a result of the break-up of its deal with AT&T even though the license transfer applications remain pending at the FCC. At the same time, Verizon fails to include the spectrum it is seeking to acquire against its own average.

Third, as Verizon acknowledges, not all wireless users place equal demands on the network and smartphones use approximately 35 times the data of feature phones. Verizon, nevertheless, declines to factor into its analysis that T-Mobile has a higher percentage of bandwidth-hungry smartphone customers than Verizon.

Fourth, and most importantly, Verizon fails to account for the fact that a majority of its own spectrum is in frequency bands below 1 GHz, which is considerably more efficient at providing coverage and capacity than spectrum above 1 GHz. All of T-Mobile’s spectrum is in the higher bands above 1 GHz.

An analysis that takes these factors into account reveals that T-Mobile is actually more efficient than Verizon is in all five of the top markets, eight of the top-10 markets, and 31 of the top-49 markets, and that, on average, T-Mobile is 50 percent more efficient than Verizon in the top markets. This is a very different picture than the one Verizon paints for the FCC and the public.

T-Mobile announced earlier this year that it would begin repurposing its existing PCS and AWS bands for the deployment of next generation LTE technology. Even with this effort to retool our bandwidth, however, we will need more spectrum to fully deploy LTE across the country.

As competitors like Verizon roll out LTE, it is important that T-Mobile be right there as well – bringing competition and choice to consumers. It is therefore no coincidence that Verizon moved aggressively to purchase the last remaining block of spectrum that carriers like T-Mobile and others could utilize to launch competitive services in competition with Verizon. Especially with the recent demise of our deal with AT&T, T-Mobile needs the right spectrum resources to remain a competitive force. The spectrum Verizon is seeking to acquire from the cable companies is uniquely situated to facilitate and expand T-Mobile’s LTE deployment.

T-Mobile has a history of buying spectrum and immediately using it – not buying it to bank it. After the 2006 FCC AWS, auction, we actively cleared a dozen incumbent federal government agencies from the 1.7 GHz band in record time to make way for 3G and 4G services. T-Mobile’s record stands in stark contrast to Verizon’s approach of buying large quantities of spectrum and letting it sit idle – in the case of AWS for five and a half years and counting. And, Verizon admits it retains plenty of capacity even as it seeks to stockpile another tranche of spectrum to meet some future demand. Indeed, Verizon’s chief financial officer recently noted that only five percent of its customer base is using its new LTE network at 700 MHz. The question for the FCC, therefore, is why Verizon should be permitted to acquire more spectrum before it has even started to use much of what it already has.

The simple answer is that Verizon’s effort to lock down the last remaining block of currently available LTE-appropriate spectrum should be denied. By doing so, the FCC would advance its pro-competitive goals for the wireless industry and create an environment in which the licenses could be made available to others who can put them to work immediately for the benefit of consumers.