T-Mobile’s JUMP! Upgrade Program, Just How Good Of A Deal Is It?

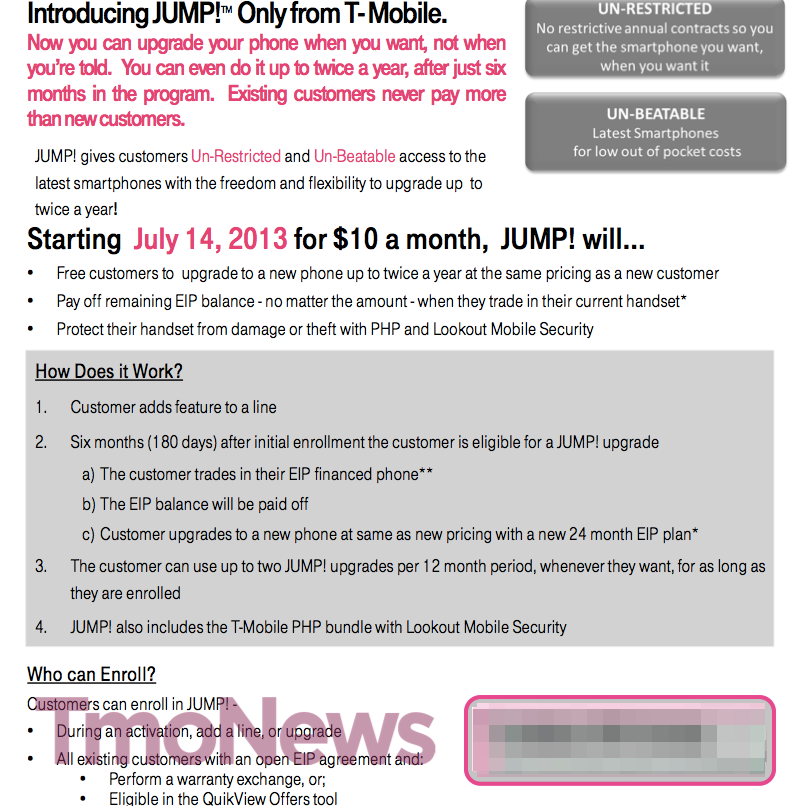

Note: The $10 monthly fee includes T-Mobile’s PHP insurance plan which makes it a good deal financially, but the real question remains the JUMP! upgrade timeframe. The $8 PHP bundle includes Insurance and Extended Warranty protection. Next business day shipping is included on all replacements. There are $20, $50, $100, $150 or $175 deductible tiers depending on the device using insurance.

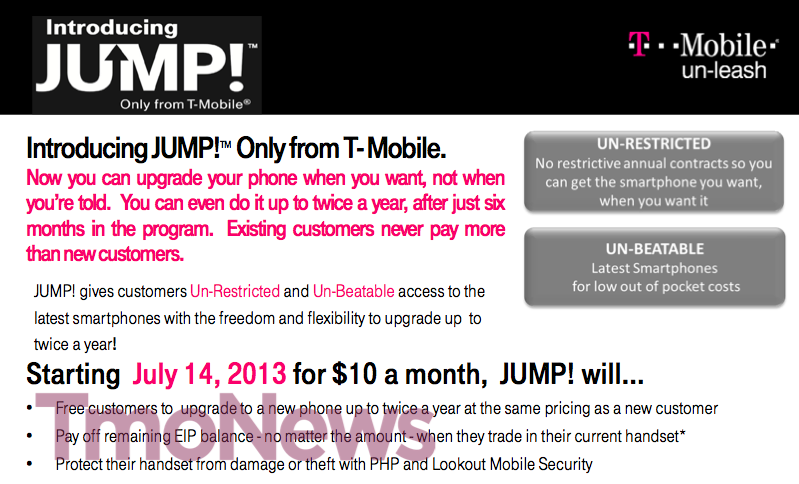

JUMP! certainly caught all of our attention yesterday as it’s definitely a “bold” move by T-Mobile. Is it their Boldest move ever? I’m not so sure and before we can run and call JUMP! a true game-changer as we need to dissect it and see just who can benefit from it and at what cost.

The question of whether or not the $10 per month for JUMP! is worth it for you is ultimately going to depend on what kind of a user you are. Do you need the latest phone the minute it hits store shelves? Then JUMP! might be for you? Do you want the iPhone 5 today but the next-gen iPhone six months from now after it releases later this year?

Let’s take the iPhone 5 as an example and say you pay the $145.99 down and then six months of monthly payments at $21 each month. That’s $272 after six months of ownership, and now lets add in the six months of JUMP!. Your total ownership over six months is now $332. That’s a little over half the total cost of the full retail price of the device.

So what happens when you JUMP!? T-Mobile takes your existing payments and wipes the leftover payments clean. You start from scratch in a way. There’s no real discount on the new device other than the new customer price, and you’re going to again use whatever financing program T-Mobile has in action for the new iPhone. But what about your $332 that you’ve already spent? Well, you’ve spent it on a phone you no longer own, can’t offer to anyone else to use and will never see it again. This where the “starting over as a new customer” line comes into play. In other words you can’t sell the old phone to help pay for the new one.

At the six month period you’ll trade-in your existing iPhone 5 for the iPhone 5S/6/whatevernameApplecallsit and you’ll do it over all over again. Let’s just say for arguments sake that T-Mobile leaves the cost the same and you’ll spend another $332 over the second set of six months in a 12-month period. Now you’ve spent $664 dollars, or $14 more than the total retail value of a 16GB iPhone 5 at $649 and you still don’t own the phone yet.

So, I look at JUMP! in a way like leasing a car, if you want to look at a car as an investment than JUMP! probably isn’t the right path for you. However, if you don’t mind switching phones out every six months and don’t have any concerns about not literally “owning” each device than JUMP! may be exactly what you need.

Now, what happens if you don’t want to upgrade every six months but want to use JUMP! anyway? Let’s now say you’ve gone 10 months with the iPhone 5. Now you’ve spent $456 dollars toward the full price of the iPhone 5 when you consider 10 months at $10 for JUMP! = $100. Ten months of $21 monthly installments = $210 and then the $146 price for the down payment. BTW, I’m rounding up for arguments sake. Now you’re only $193 dollars away from what would be the total cost of the iPhone 5 at $649. Of course that number is boosted because of the extra $100 on JUMP! but the opportunity cost of JUMP! seems to be minimized the longer you wait to upgrade. If you wait longer than 10-12 months without upgrading than I would probably say to ignore JUMP! and keep on keeping on.

Now, I could do the math any number of ways and I could check the total cost of buying a phone outright, only one upgrade a year etc but I’ll let you guys handle the different scenarios. The bottom line is that no matter how you slice it, T-Mobile’s upgrade process still appears to be far less expensive than that of AT&T or Verizon if you chose to upgrade every six months with comparable service on either of the two giant carriers.

The real issue here seems to be at what point you take advantage of JUMP!, because in my eyes the earlier the better. As soon as the sixth or seventh month strikes on the calendar, upgrade, upgrade, upgrade. There’s a good chance something new will be on store shelves at that point anyway that might entice you. If you have no qualms about physically owning the device after making the monthly installment payments than JUMP! is for you.

T-Mobile’s real target here seems to be the early adopter, the influencers, the high-value customers that has long found the smartphone selection of AT&T and Verizon (and data speeds) far better than that of the number four carrier. Now that T-Mobile is doing something about the phone choices and the data speed and cost, they are turning their attention to winning back those customers and JUMP! may be the first in what appears to be many salvos geared toward doing exactly that. As T-Mobile CMO Mike Sievert wrote:

“One of the things that really bothers people about two-year upgrade cycles is if they’re an enthusiast of one of these lines, like the Galaxy line or the Sony line, they’ve got to generation skip. And people hate that.”

T-Mobile says JUMP! is listening to the customer and considering the negative feedback from both Verizon and AT&T customers upon learning their upgrade cycle was now 24 months was that of disdain. T-Mobile still has plenty of room for improvement when it comes to battling the coverage stigma which long been one of the biggest thorns in their side. Legere can take as many potshots as Sprint or AT&T as he wants, and companies like RootMetrics can show T-Mobile as gaining significant ground but until the end consumer sees it and tells their friends, there’s still the coverage elephant in the room. Even if T-Mobile were to win over these influencers, or even a minority part of them it might be small ground in terms of overall subscriber growth, but word of mouth from these folks will be worth its weight in gold. Will JUMP! be the conversion tool T-Mobile hopes it will be? Time will tell, but it’s definitely a step in the right direction for a carrier that wants to be the “UNcarrier.” How well it works for you is simply a matter of “when.”

Have you crunched the numbers for JUMP! on your own?