Speculation over Mexican billionaire buying T-Mobile is just that, speculation

4 days ago, the Wall Street Journal published a report detailing Mexican telecoms giant, Carlos Slim’s recent dealings with regulators in Mexico. His issue is that he owns a huge portion of the telecommunications industry in Mexico, and the governing bodies are forcing him to sell a sizable chunk, worth around $15 billion.

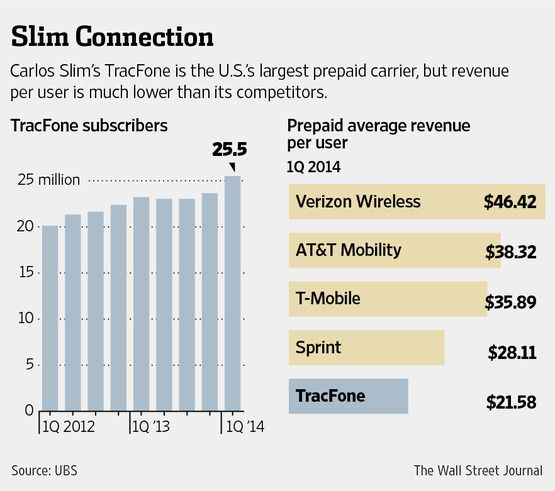

In its report, WSJ offers details on his other investments, including TracFone, which is the 5th largest wireless provider in the States. It operates under seven brands including Straight Talk, Simple Mobile and Telcel America, among others.

This turn of events has caused speculation as to what Slim might do with this mighty sum of money.

Since the report was published, a large number of our keen-eyed readers wanted to bring it to my attention, and I’d initially not planned on publishing anything on it at all. And it’s all because of one paragraph within the report:

“A more meaningful entry into the U.S. with the acquisition of [T-Mobile] could make strategic sense,” analyst John Hodulik said. He projects Mexican asset sales would yield more than $15 billion for Mr. Slim. That cash also could go toward expanding his telecom businesses in Brazil or Europe.

Several other blogs picked up on it, and decided it was worth the effort to publish speculation that Sprint and SoftBank have a competitor – albeit a late coming one – to its plans of acquiring Deutsche Telekom’s U.S. carrier. And yet I can’t help feel there’s really nothing in this at all.

Slim is well-placed and knows the U.S. industry, that’s true. He’ll have an extra $15 billion to spend in his bank, this is also true. However, when you consider that he’s one of the richest men in the world with a net worth of almost $80 billion, chances are someone with that level of financial clout who’s already in the industry, would have already made a move. Or at least, stated that he might be interested. Which he isn’t.

And then there’s the other issue with the statement. Nothing within the report even slightly suggests that any sources with any knowledge have come forward to suggest that Slim is even considering a competing bid for T-Mo. In fact, it almost seems like a throwaway comment. Paraphrased: “He might buy T-Mobile, it’d make sense, but he could also just as easily invest the money in Europe or Brazil.”

Also consider this statement from the article:

Bankers have pitched him on U.S. targets over the years, including T-Mobile, Leap Wireless and MetroPCS, but Mr. Slim wasn’t interested, according to a person familiar with the matter.

When discussing its move into Europe two years ago, the company said it considered increasing its U.S. investment but that it didn’t want to jeopardize a TracFone model that has worked well with minimal capital commitment.

In other words, he likes the model of owning one big company that acts as an umbrella covering a handful of smaller carriers. Owning one of the Big 4 would be a different proposition entirely, given that he’d then have to start factoring in the costs involved in improving and expanding its coverage. Instead of just paying to piggy-back off another carrier’s network, as he does currently.

Stating that Slim could buy T-Mobile is just as accurate, therefore, as a guess stating that Slim won’t buy T-Mobile.

When you add the fact that it’s an educated guess, to the fact that discussions between SoftBank and Deutsche Telekom are already so far advanced, it’s unlikely that DT would consider even discussing the notion with any other party. And let’s also consider the purpose of any merger with Sprint. It’s to become a strong 3rd carrier, to challenge the big two. Slim may be a billionaire, but his market interests in the U.S. are exclusively smaller, prepaid MVNOs operating under one company that require a much smaller financial commitment.

Speculation from an analyst therefore is just that, speculation. In the same way that an analyst might suggest Apple needs to release a cheaper $300 iPhone to address certain markets, or that Facebook needs to charge a subscription fee, one has suggested that it would make sense for Slim to have a gamble on T-Mo. Nothing more.

He might bid. He might not. That is the crux of this story.

UPDATE – He almost certainly is not considering buying T-Mo US.

During his company’s quarterly results call earlier today, the CEO stated that his approach to the U.S. market is not changing. Analyst, Walter Piecyk of BTIG quoted on Twitter:

@PhoneDog_Cam $AMX CEO on buying a US operator: “No. We haven’t changed our strategy. We are comfortable with how Tracfone is working”

— Walter Piecyk (@WaltBTIG) July 22, 2014

Source: WSJ

Edited article – Wrongly stated the forced sale would result in $15 million income, not $15 billion.