Public Service Reminder: New Premium Handset Protection Coverage Rolls Out Today

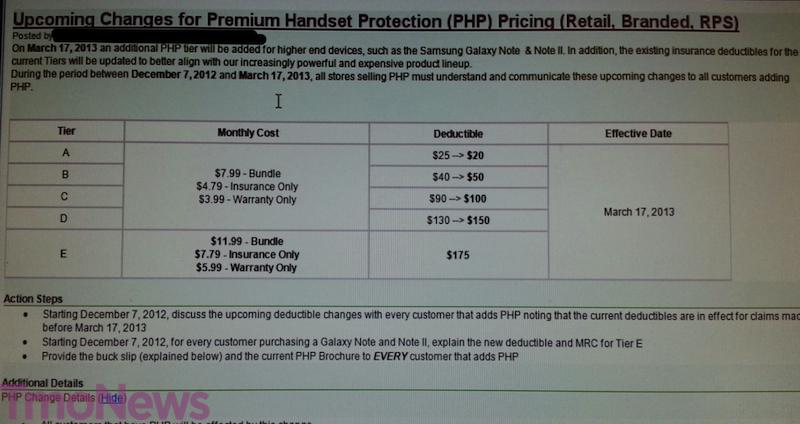

A quick public service reminder for all you in T-Mobile land as today, March 17th marks some changes to the carriers Premium Handset Protection plans. As of today, an “additional PHP tier has been added for higher end devices, such as the Samsung Galaxy Note and Note II. In addition, the existing insurance deductible for the current Tiers will be updated to better align with our increasingly powerful and expensive phone lineup.”

The new Tier, E, will introduce a $175 replacement deductible with a monthly charge of $11.99 per month. If you choose to go the insurance only route, you’ll pay $7.79 a month and $5.99 monthly for extended warranty only. As a quick reminder, warranty services only covers mechanical or electrical defects, not lost, stolen or damaged.

As we speculated back in December when we first got word of the new plan change, we believe the new tier has been designed to welcome the likes of higher-end devices like the iPhone and potential Galaxy Note II successors. Existing deductible costs are also changing today:

- $25 – $20

- $40 – $50

- $90 – $100

- $130 – $150

- New Tier: $175

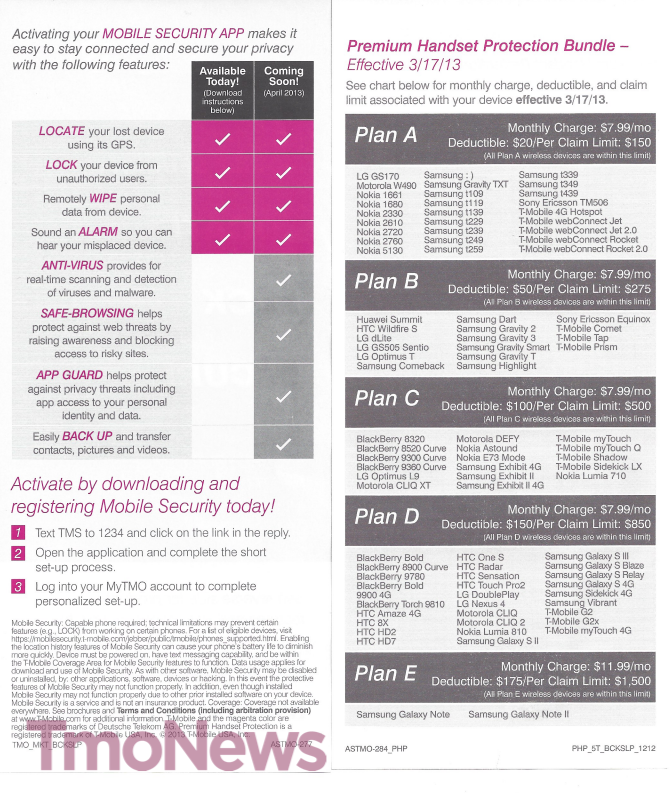

Monthly costs for Tiers A – D covering existing handsets as shown in the above image cost $7.99 a month for both extended warranty and insurance coverage. As standalone features, insurance is $4.79 with warranty costing $3.99 as individual plans.

All customers with existing Premium Handset Protection packages should have received the above mailer alerting them to todays changes.